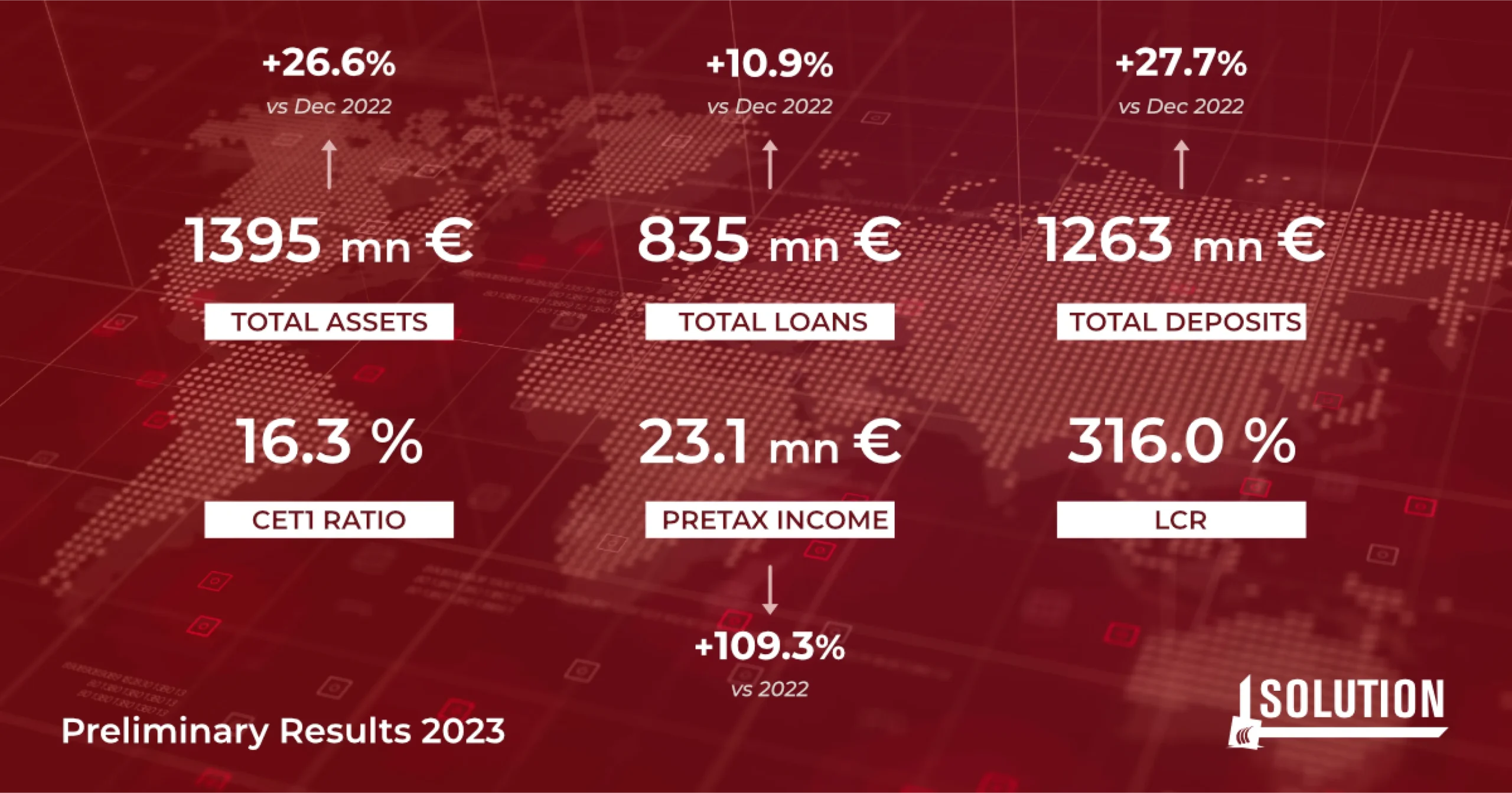

Great success for Solution Bank in 2023! With a record pre-tax profit of 23.1 million euros, up 109.3% compared to 2022, our Cost/Income ratio stands at 44.8%, while the annualized ROE reaches 15.7%. Our total assets grew by 28.6%, reaching €1.4 billion, while maintaining a net NPE ratio of 6.1%, a strong capital position (CET1 at 16.3%), and a liquidity ratio (LCR) of 316.0%. Our growth trajectory continues successfully, exceeding economic performance expectations. In 2023, our Bank disbursed over €230 million to medium and small enterprises, supporting them in significant operations for their growth and development. Our deposits increased by 28%, reaching €1.3 billion by the end of 2023. In this regard, since the end of December 2023, the Conto Yes has been launched—the fully digital online deposit account available to all Italian savers. On February 8, 2024, the Bank’s Board of Directors approved the 2024-2028 Business Plan, which includes key strategic initiatives such as strengthening client relationships, setting up a Leasing platform operational from 2024, further developing the Distressed Debt and Special Situations segments, and expanding geographically through the opening of new branches to attract new retail and corporate depositors. To achieve these objectives, the Bank will rely on its entire team of employees and a comprehensive investment plan in new expertise and technologies. General Manager, Frank Fogiel comments: “I am extremely proud of the outstanding work done by the entire Solution team, who have diligently developed the Bank’s businesses, passionately supported our clients, and continually improved our processes and internal controls. We are ready to enthusiastically pursue our goals and become an increasingly prominent benchmark in the market.“.