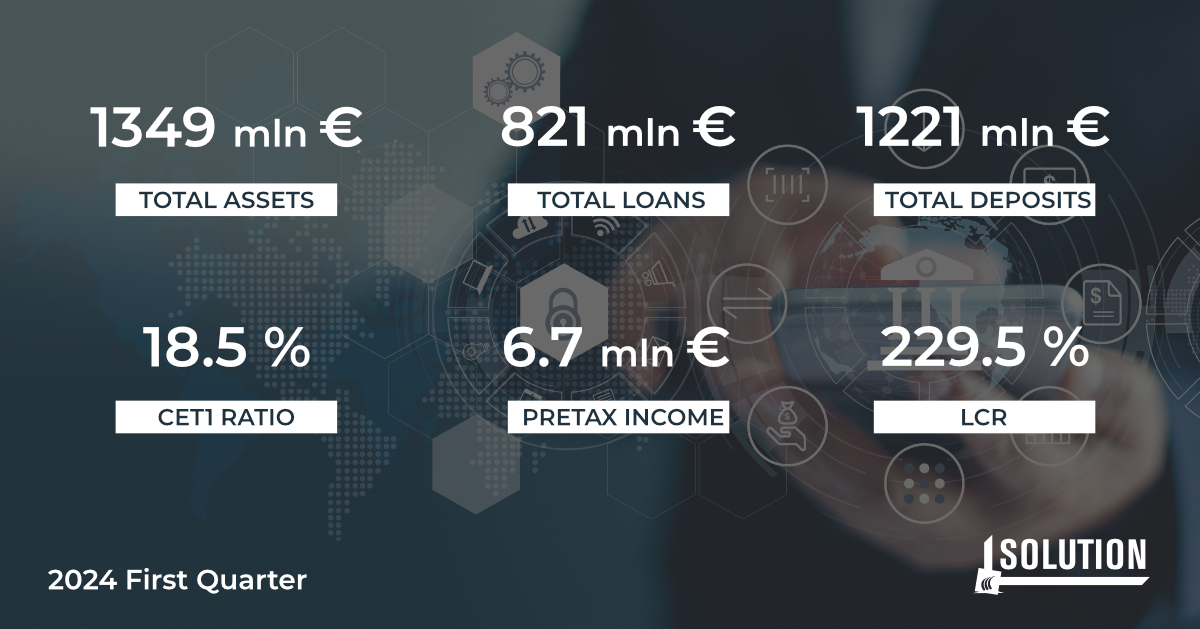

Solution Bank closed the first quarter with a pre-tax profit of 6.7 million euros. The Bank has exhibited an outstanding profile of efficiency and profitability, with a cost/income ratio of 45% and an annualized return on equity (ROE) of 17%. The total assets amount to 1.3 billion euros, with a loan portfolio of 821 million euros and direct deposits of 1.2 billion euros. Solution Bank maintains a robust capital position with a CET1 Ratio of 18.5% and a Liquidity Coverage Ratio (LCR) of 229.5%.

- At the beginning of this year, Solution Bank launched three strategic initiatives, in line with the 2024-2028 growth plan:

- Solution Lease: a new leasing platform operational from the second quarter of 2024;

- Conto Yes: a new, fully digital online deposit account;

- New Retail Branch in Modena: expansion of the branch network and increased territorial coverage.

Additionally, the Bank has devoted significant efforts to enhancing the services offered to businesses, with a particular focus on SMEs and a specific sensitivity towards local companies, providing comprehensive and timely solutions. These initiatives aim to consolidate Solution Bank’s position as a trusted partner for businesses, actively contributing to local economic growth and providing customized banking solutions aligned with evolving business needs.